The Unstoppable Grift: How Coinbase and Binance Helped Turned Web3 into Venture3

how do you stop a $10B snowball?

My last post made a bit of a splash, you could say.

Thanks Jack!

But there was one area I didn’t have time to dig into fully - the link between Coinbase and Coinbase Ventures. The conflict of interest looked so bad, Coinbase issued a statement a week after my post, noting that they kept strict separation between their Ventures and asset listing teams and had never sold a token. Problem solved, right?

And then FTX, Coinbase’s fast-rising competitor, raised $2B for their own ventures fund. And now a16z is raising $4.5B for their latest mega-fund. Lots to dig into.

But before we get to that, let’s talk about the last post where I wrote that Coinbase’s listings didn’t perform very well. What if we added Binance for a comparison? Would that help us understand if there’s something particularly weird going on?

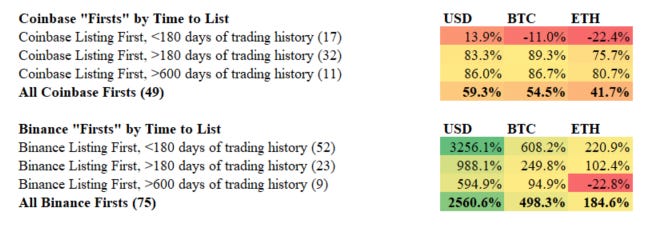

What I found supported my idea that there’s a “Coinbase curse” - the average returns on Binance blew Coinbase out of the water - although the difference in the returns was staggering.

And the thing is, I think Coinbase knows that. Because if you look at the direction they took in 2021, they made a sharp turn to not only add a lot more assets, but being first to list coins, even some on the first day.

That seems risky to me. These are coins with tiny floats that may have only been founded as little as a year prior, and now they’re in the hands of tens of millions of retail investors - who the data shows are often less sophisticated than investors in stocks.

Why else does it matter? It’s also clearly the direction all of the industry is going in: exchanges creating huge venture funds and then aggressively listing coins (often that they’ve invested in) faster and faster. All while they shovel tens of billions of dollars into web3 startups to create an “ecosystem” of more coins that they can use to generate trading revenues.

But I’m wondering when that strategy might backfire. Because when I looked at the data, Coinbase not only did worse than Binance, but coins with less than six months of history underperformed, and the “Day Zero” listings - those listed immediately, nearly all of them affiliated with Coinbase Ventures - did the worst.

Was every exchange this aggressive to list coins faster? I looked at all their venture activity and found that every major exchange had in fact listed their own investments mere months after investing in a venture round - sometimes even listing them at the same time.

Is there anything that can slow this snowball? Or has the grift simply become unstoppable?

The Heavyweights Meet

For years, the lines were drawn. Coinbase was the cautious, do-gooder exchange, and Binance was the bad boy exchange who threw caution to the wind and gave listings out freely. In fact, CZ himself writes in his “listing tips” that they have “no hard requirements” and that saying nice things about Binance is essentially half the battle.

By the end of 2020, Coinbase barely had 50 coins listed, versus hundreds on Binance. But in mid-2021, Coinbase suddenly pivoted its strategy, aiming to become the “Amazon of assets.”

As I wrote in my last post, listing on Coinbase is a mixed bag - driving an initial pop but then getting worse over time as the coin starts to lag Bitcoin and Ethereum. Coins that Coinbase explicitly rejected did far better than those listed. My theories were a mix of insider selling and dollar liquidity.

What about on Binance? Would listing there have the same effect? I took a look at the same 129 coins Coinbase had ever listed and looked instead for the returns since the day Binance had listed them, usually long before Coinbase (107 coins). The numbers are stark:

So not only does Coinbase seem to have a negative effect on coins after listing, but they seem to underperform their most important competitor.

What was Binance’s major advantage? It was mostly driven by more home runs:

Binance had 7 100x’s in USD terms while Coinbase had none.

Coinbase’s biggest home run was a 50x.

Coinbase only had 3 10x’s, while there were 15 for Binance.

Those 100’s were a mix - some were old (Chainlink, 2017) and some were new (Axie Infinity, 2020). But the key was Binance got to them earlier.

This could be overly harsh on Coinbase - one of the theories I gave previously was that they might be the only honest exchange, with proper market surveillance and controls against wash trading, Coinbase provides true price discovery for all these coins and inevitably shows how little most of them are worth.

Unfortunately, honesty doesn’t always pay. Having to wait for legal clarity and a liquid market meant losing some of those massive returns that come early on.

Tired of playing second fiddle, Coinbase switched to listing early and often. During 2020, Coinbase listed before Binance on only 4 out of 18 listings. During 2021, that number shot up to beating Binance on almost half of their joint listings: 42 coins out 95. The number of coins that have never been listed on Binance, but listed on Coinbase, jumped from zero in 2019 and 2020 to 21 in 2021. If we look at that year, the strategy seems to have paid off somewhat in slightly higher returns:

It seems Coinbase was able to capture more of that excitement around the first listing on a big exchange and the related “pop.” So problem solved, right? Clearly there’s an advantage to listing faster and before your rivals. Just list the coins as soon as you can.

Well, Coinbase tried. It didn’t go so well.

I gathered data on how long coins had been tradable by looking at the date when pricing data was first available for a coin on CoinGecko or CoinMarketCap. That’s not a guarantee for the first possible trade, but they cover all the major exchanges and DEXes. (I spot checked a number of these and found the data was almost always within 1 day of the token generation event.)

When I split up their listings by time since the first trade: there was a pretty clear theme for Coinbase. The old coins popped, and the new coins flopped.

Binance, again, didn’t seem to have the same problem. That could be for any number of reasons: perhaps market manipulation, more insider selling on Coinbase (especially if teams and investors are US-based), or that many Binance listings were trading pairs against BNB (Binance’s own coin), which itself has appreciated 600% in the last year.

On the other hand, the Coinbase “firsts” fall into two camps - older coins (>180 days, count of 32) that popped with a huge influx of volume and newer coins. That includes some names like Circuits of Value, Quant, and Alchemy Pay. The newer coins (<180 days, count of 17) on the other hand underperformed BTC (and probably stocks, for the record). Out of those 17, 7 were Coinbase Ventures related.

This is important for all exchanges, not just Coinbase: if newer coins keep flopping, it will hurt investor returns, and there’s only so many old coins they can list. The big difference between old and new coins basically came down to liquidity: some of the old coins were barely traded at all. In fact, COVAL went from $20k in daily volume to $250M in less than a week, a 10,000x increase! XYO Network similarly went from $150k in volume in mid-July to $100M+ after its Coinbase listing, a 1000x. Alchemy Pay went from $1-2M the month before listing, to $10-20m the week before (surely a coincidence), to $100M+, a 100x in volume. That flood of buyers caused the price to 60x in a week

That kind of influx will make any asset explode in price, and unsurprisingly, COVAL and XYO have lost 50% from their post-listing highs, even against BTC. My guess is these teams probably saw Coinbase’s pivot, took action, and having never traded on Binance before, ended up with huge pops.

Coinbase either went for coins likely to pop, or got lucky, because the newer coins did not perform the same way. That’s unfortunate, because that seems to be the direction not just Coinbase but the entire industry are going - newer coins from their own pipeline. And a particular category of new coins might show how bad that could be for retail investors.

The Day Zero Listing

In 2021, we also saw an explosion in a new trend: coins that exchanges listed for trading on essentially their first day of existence. In the past, exchanges would wait for enough liquidity or a community to grow sufficiently to show price stability before listing small coins. But now as exchanges race to beat each other, Coinbase, Binance, and others have become more aggressive on some projects to list as soon as the token is created.

To see how these coins did, I filtered for listings that were within a day (in one case a week) of market data on the major sites. Instead of showing another boring wall of numbers, let’s just look at the charts of some of these coins since Coinbase listed them, shall we?

Biconomy (12/1/21)

Clover Finance (7/16/21)

Orchid Protocol (12/19/19)

Goldfinch (1/11/22)

That last one, Goldfinch, certainly raised a few eyebrows - a16z had announced it was leading a round only 5 days earlier, and Coinbase Ventures was an investor too. Not only that, but the company was also founded by two ex-Coinbase employees.

But Coinbase promised that the listing and Ventures teams are totally separate, with no influence on each other?

Sadly, though, even that “distance” isn’t making much difference in the outcome. Out of the nine coins I found that were listed nearly immediately, only one wasn’t either a CV or a16z investment - Clover Finance (CLOV), and seven were direct Coinbase Ventures investments.

Let’s look at those overall “Day Zero” returns:

With my last post, one counter argument was that investors on Coinbase might be underperforming Bitcoin, but were not always losing money in USD. That’s not the case here. Seven out of nine of these coins have lost money, and four are down -70% or more.

There were also three coins that by my data were listed immediately on both Binance and Coinbase at once: Uniswap (both CV and a16z backed), The Graph (CV only), and Internet Computer (a16z only). Adding those to the mix doesn’t improve returns much, as only the Graph has done well and the other two lagged BTC quite badly:

Just for fun, let’s compare it to the coins Binance listed on Day 0 from my set:

Still don’t believe in the Coinbase curse?

Honestly, the numbers are crazy. I’m only looking at 107 of Binance’s nearly ~400 coins, so there might be more Day 0s out there, but this is a big sample. Binance’s Day 0s included a 500x (Axie), a 300x (Polygon), and 3 100x’s (Chainlink, Solana, Enjincoin).

The highest return for such a fast listing on Coinbase? A triple.

Feeding the Ducks

Now, is Coinbase at fault? Perhaps not - it could be that token teams who decide to pitch Coinbase Ventures apply for listing at the same time or soon after. That would lead to an adverse selection bias, where teams that want to dump fast try to list ASAP.

Day Zeros have some other incentive problems:

Smaller floats make the prices more volatile

Insiders on projects that will see a lot of dilution would want to list sooner

Investors might push projects to list so they can exit

Exchanges get in competition to list fast and first

There’s also something unsavory about all these “web3” projects going straight to listing on a centralized exchange. After all, isn’t this all about decentralization? These tokens are supposed to be for use in a “community” (compared to an exchange where you don’t even have custody) or some other utility-value, but the teams in charge are racing to get them listed where they can only be bought and sold - and investors can cash out.

As for exchanges, even with Coinbase’s claim of independent decision making for individual coins, there’s a general conflict of interest: if their Ventures arm is going to be investing in a new coin every other day, they’re incentivized to make the listing requirements as lenient as possible. Which is basically what’s happened!

Coming back to returns - what differences are there between the Coinbase and Binance day zeroes besides the explanations I gave above (market manipulation, dollar liquidity)? I think there’s another clear story in these two charts that illustrate how many ducks each project had to feed with token allocations:

These are the allocations for Goldfinch and Enjincoin at launch. Goldfinch, the Coinbase coin, is full of insiders and “stakeholders,” and only ~4% the total supply was tradable at launch (schedule below). That’s much lower than what would be considered a “low float” IPO of around 12%, and traditional VC investments don’t have to hand out tokens to 9 different parties. For Goldfinch, half of the initial supply was given to early Liquidity Providers with no lockup. I wonder who was dumping?

Meanwhile, Enjincoin, the Binance coin, has an insider allocation less than half as big, and without all the “incentives.” I can’t find any documentation of a lockup for investors, so it seems that most of the supply was all tradable at launch (the team had a 2 year lockup and advisors were locked up only 2 months!).

Now, three years later Enjincoin has about 93% of its total supply available, while the liquid supply of Goldfinch is slated to be diluted 25x over the next 3 years: I wonder which coin is going to do better?

“Proof-of-Alignment”

Of course, all this “Day Zero” stuff is a great fit with Coinbase CEO Brian Armstrong’s ethos. After all, we shouldn’t forget that the Coinbase IPO wasn’t an IPO at all - it was a direct listing, which meant no lockup, and Coinbase’s leadership were happy to do the same day one dumping.

Unlike an IPO, which is meant to raise funds for a growing company, the entire purpose of the Coinbase direct listing was to create liquidity for its holders. Armstrong led the pack, dumping $300M of his own Coinbase stock the on the first day at $380 of trading. Now you’re stuck holding the bag below $200, nearly half his price.

Not to be outdone, Union Square Ventures sold $1.5B on day 1, Chief Product Officer Surojit Chatterjee sold $60M (and has kept selling all year), President Emile Choi sold $100M, and co-founder Fred Ehrsam has continuously unloaded over $100M since the listing.

The Block put together this helpful chart of how much of their holdings they couldn’t wait to offload to retail at all-time highs:

Marc Andreessen chipped in his bit too - selling $200M about four months later. How else could he have bought that $177M mansion, managing to top Armstrong on the list of biggest real estate transactions in 2021? Proof of alignment indeed.

And the day zero returns I talk about above are of course based on the investments we know about. After my original post and an expose by the FT, Coinbase scrambled to explain how they themselves for months had claimed to have “200+” investments yet had only disclosed 70 on their website (screenshots at bottom).

Now, some rounds are private, but I simply downloaded their investments from Crunchbase and found 177 unique investments. (After the FT article, their disclosure jumped to 94 investments, and was about ~130 at the time I’m writing - still seemingly missing a number.) It’s also a fair question I think if exchanges should be participating in private rounds at all.

The Curious Case of Livepeer

At this time, I’m still digging up some mysteries - like why Coinbase doesn’t list Braintrust in its disclosures, but Braintrust had CV front and center on their website:

(screenshot from 2/2/22)

Uniswap and Livepeer weren’t on their website either until my article went live, although they’re listed there now. And until the updates, the only way to know about Coinbase’s relationship with Ribbon Finance was a tweet they did for their seed round:

The Livepeer case also caught my eye - like the Goldfinch listing, some of the dates seemed weirdly close in time. Coinbase was part of an investment round announced on July 29, 2021 - a mere four weeks after Coinbase listed the coin on June 23rd.

Now, a VC investment usually takes a few months of legal wrangling to get all the details sorted out. Did the “separate” teams know that a VC deal was going on? Are we left to believe that these happened closely by complete chance? I might believe it if it were some unheralded coin that everyone was excited for, but this was a small project focused on P2P video.

Funny enough, I had a chance run-in with the CEO of Livepeer a few months prior to all of this. He noted to me that his number one strategic goal for 2021 was to get listed on a major exchange. I wonder if that influenced which VCs they chose to pitch. Sounds like value creation to me!

The Gang’s All In

All this talk about Coinbase - what about the other big exchanges? None of them are as active in venture investing and most don’t list nearly as many tokens. But that doesn’t mean there are plenty of eyebrow-raising examples:

Gemini. The Winklevoss twins have been major proponents of NFTs and the Metaverse, starting with their acquisition of Nifty Gateway, an NFT marketplace, two years ago. That also led them to invest in the Sandbox, a Metaverse related project they invested in that was announced April 8th, 2021. The full terms of the investment weren’t clear, but as part of the Sandbox deal they were required to purchase LAND NFTs that represented virtual land in the Sandbox metaverse.

As I noted before, these investment deals don’t happen overnight. So it’s a near certainty that Gemini’s venture arm was negotiating this deal simultaneously as the exchange worked to list the Sandbox coin two weeks earlier on March 23rd, 2021. Of all the exchange-venture activity I looked at, this one smells the worst.

The rich irony of course, is that the coin barely budged for six months - until lifelong Winklevoss nemesis Mark Zuckerberg announced Facebook’s name change to Meta, which caused an immediate 10x in the price of Sandbox.

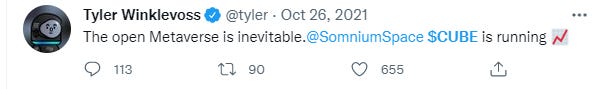

One case seems hard to trace: Gemini listed a small, illiquid coin called Somnium Space (which seems to only trade there and on Uniswap, with a daily volume of $360k) on March 23rd. The company later announced on Oct 26th that the Winklevoss twins had invested in the company in 2021, with no investment date included. The twins then spent the day tweeting their excitement about it:

Followed by congratulating themselves as the price proceeded to 10x+ from whenever they invested, going from $2.65 to $26 in a week:

See any mention of their vested interests? Neither do I. (Their “new token” blog posts on Gemini don’t bother with disclosures either.) Nor do we know any of their lockups, ownership stakes, and so forth.

This just looks like your usual celebrity endorsement, except that, you know, they own the only major exchange it trades on.

Kraken. Kraken isn’t very active as a venture investor, but they do have a venture fund. Sometime in Q4 2021 they invested in Acala, a Polkadot lending protocol, and went on to give it a day zero listing less than four months later in January 2022.

FTX. FTX, despite having a $2.5B fund, doesn’t seem to list their investments at all on their website. That alone should tell you the state of oversight in this industry..

In any case, I was able to dig up a couple interesting FTX related cases on Crunchbase:

1inch. FTX invested in the seed round 8/11/20, and FTX went on to give 1inch listing for both spot and futures less than four months later on 12/25/20, the first day of trading. Binance Labs was also in the seed and joined for the day zero listing. Quite the Christmas present!

SkyMavis. FTX made an investment in one of the hottest startups of the year, SkyMavis, which is the maker of play-to-earn game Axie Infinity. After completing an investment on 10/5/21, FTX announce it would list SkyMavis’ Ronin coin, a governance token for a gaming sidechain - a critical piece of the future financial industry, obviously - on 1/6/22 and perpetual futures soon after. The token immediately slid 35% within a week of its debut.

Binance Labs. Binance Labs, the venture arm of Binance, is fairly active in the VC space, with at least 80 holdings advertised on their website. I found at least six Day Zero listings alone - 1inch, Axie, Band, Cartesi, Fetch, and Polygon - included in the 107 coins I’ve looked at, so I’m sure there’s many more among Binance’s 400 listings, and even more that were listed not long after the first day.

The returns for these six coins were also sky high: the two highest returns of any coin I found were among this group (Axie and Polygon). That draws up other suspicions, considering crypto exchanges have a controversially expanded role compared to traditional exchanges, essentially acting as custodian, broker, and exchange all at once. Stock exchanges are regulated to provide the best price, but not so for crypto exchanges - and we are talking about Binance, an exchange that has run so afoul of the law that it cannot find a country to establish its headquarters.

(Sidenote: while reviewing the exchanges’ venture activity, my favorite detail was finding out that Messari - one of the most prominent research shops in crypto - had taken funding from all three of Coinbase, Gemini, and Kraken. I’m sure their coin assessments are very independent regardless.)

The Unstoppable Grift

In my last post and in my conversation with Laura Shin I mentioned a bunch of solutions - some regulatory, some voluntary from the exchanges - I thought might fix some of these conflicts.

But having done further research, I’m not sure there’s anything that can fix this. All you have to do is look at the time lapsed between seed rounds and listings on these exchanges.

Here’s the ages of those eight day zero projects I found had a Coinbase affiliation. Half of them were listed only six months after Coinbase Ventures made an investment, and the average performance was, well, bad.

In traditional VC, a third of your investments go to zero, another third provide low returns, and only a third generate success. That means VCs have to be savvy about their investments. But if you can get some coins to 10x in six months, and grab liquidity on the two-thirds that would’ve been losers too, the economics completely change. You can simply “spray and pray.” And it looks like these funds are, with CV shoveling $4B into crypto in 2021 and doing deals every 2 days.

Coinbase and the other exchanges want to say that their policies and disclosures can fix things. But the reality is all of the exchanges are operating in a clear race to the bottom - looking to list as many coins as they can, as fast they can, with no regard for returns (except maybe their own), dilution, or use cases. Disclosures can’t fix a collective action problem.

At the end of the day, more trading pairs equals more revenue, and exchanges are addicted to that surge in volume that a listing creates. Even if every coin were to go to zero, arbitrageurs would still be trading them all the way down and making the exchanges money.

That’s one reason all these exchanges have started VCs - they want to fund the “ecosystem” so that there are more coins to trade. Now we have another race to the bottom - to get into the most crypto rounds as early as possible.

They’re collectively shoveling what will probably amount to $10B this year into the crypto startup market - enough for 300 $30m Series A’s. Honestly, I had to laugh writing that. Like a poor French goose, whatever half-decent startups might be out there in crypto land are probably being hounded by hungry investors, while the market gets drowned in a flood of new coins.

With hundreds of millions in liquidity available less than one year from investment, that creates a snowball effect. Trading revenues turn into VC rounds that turn into more trading revenues. How else has a16z gone from a $300M fund to $2.5B to $4.5B in less than four years? If these VCs are serious about the “web3” ethos of full transparency, they should be doing far more to disclose their holdings.

Brian Armstrong says Coinbase wants to be the Amazon of assets, which I guess would make him the Jeff Bezos. But to me these exchanges are more like Travis Kalanick at Uber - racing ahead of regulators, hoping to make enough money to pay whatever fines will inevitably come their way.

Frankly, I wouldn’t call investing and then exiting low quality projects within a year by selling to retail “VC” at all - it’s GC, Grift Capitalism, with insiders and exchanges as judge and jury. And I doubt anything will stop it until someone is in handcuffs.

Investment disclosures: Long BTC, ETH and USD.

Special thanks to Mo Elawad, Alex Vartanian, Johnny Yaacoub, Ahmad Hammoudi, and Ali Khan for their help with this piece. Follow me on Twitter!

Notes

In some cases, Binance announced a planned listing before the first date available on CoinGecko (usually with one day lead time). In those cases, I used the first available price on CoinGecko.

The Bounce token migration made it impossible to get the old prices, so I had to remove that from the dataset.

One other case of odd timing I found - on June 16th, 2021, Binance announced they would open Keep Network for trading the next day. The next day, Coinbase announced they would list it as well. Keep had been trading for more than a year and a16z and Coinbase were investors, but hey, could be random chance. Just like that volume and price spike before the announcements was total chance, I’m sure.

I'm glad to see someone highlight the Coinbase direct listing con. One thing I would add is that they all probably sold everything they could - selling more may have meant flooding the market and receiving less than they otherwise would.

Great article Fais!