If you’re going to build a ladder to the sky, you’re going to have to lean it on something.

Tether (USDT) is the most used cryptocurrency in the world, reaching volumes significantly higher than Bitcoin. Each coin is supposed to be backed by $1, making it “stable.” And yet no one knows if this is true.

Even more odd: in the last year, USDT has exploded in size even faster than Bitcoin - going from $6B in market cap to over $60B in less than a year. This includes $40B of new supply - a straight line up - after the New York Attorney General accused Tether of fraud.

Coinmarketcap.com

In fact, for more than five years - USDT has been dogged by suspicions that the currency is not backed by real US dollars. Numerous articles and videos have pointed out Tether’s legal problems, issues accounting for the money and that it may be the biggest crypto scam of them all.

Bernhard Mueller, my former colleague at ConsenSys, does a great job spelling out how Tether could be a black swan - a chink in the armor that could bring down the crypto ecosystem.

An analysis by two academics in the most respected journal in finance went so far as to conclude that USDT was unbacked, and being “printed” solely to prop up the price of Bitcoin.

And still, on any given day, the price of USDT barely budges from $1. This even as the daily volume of USDT is equal to all Bitcoin and Ether volume combined, making its stability critical to the liquidity of the crypto ecosystem.

Coinmarketcap.com

It seems clear Bitcoin’s ladder to go up leans on Tether. But what is Tether leaning on?

How can this go on when everyone has doubts? Does the fact that it might be fake even matter?

It seems it doesn’t. In fact, the mystery of Tether’s stability might even explain a number of crypto mysteries.

The Finger Trap

There’s plenty of articles out there documenting questions about Tether’s supply. What interests me is that they manage to have success anyway. There are essentially two scenarios around Tether: that it’s either fully backed or unbacked.

The unbacked scenario is what concerns investors. If there were a sudden drop in the market, and investors wanted to exchange their USDT for real dollars in Tether’s reserve, that could trigger a “bank run” where the value dropped significantly below one dollar, and suddenly everyone would want their money. That could trigger a full on collapse.

But when that might actually happen? When Bitcoin falls in the frequent crypto bloodbaths, users actually buy Tether - fleeing to the safety of the dollar. This actually drives Tether’s price up! The only scenario that could hurt is when Bitcoin goes up, and Tether demand drops.

But hold on. It’s extremely unlikely Tether is simply creating tokens out of thin air - at worst, there may be some fractional reserve (they themselves admitted at one point it was only 74% backed) that is split between USD and Bitcoin.

The NY AG’s statement that Tether had “no bank anywhere in the world” strongly suggests some money being held in crypto (Tether has stated this is true, but less than 2%), and Tether’s own bank says they use Bitcoin to hold customer funds! That means in the event of a Tether drop/Bitcoin rise, they are hedged.

Tether’s own Terms of Service say users may not be redeemed immediately. Forced to wait, many users would flee to Bitcoin for lack of options, driving the price up again.

It’s possible Tether didn’t have the money at some point in the past. And it’s just as possible that, with the massive run in Bitcoin the last year Tether now has more than the $62B they claim!

In that case Tether would seem to have constructed a perfect machine for printing money. (And America has a second central bank.)

But note that without real audits from Tether, we can only speculate. The “fully backed” scenario poses an even stranger question - even if we take Tether at their word - that every coin has a dollar behind it - how do users have such a strong belief in its value? With all the mystery around Tether - avoiding audits, hidden relationships, and secret owners - how is there $60 billion in demand for the coin, even with safer alternatives (USDC, DAI)?

The Invisible Hand Plays Hot Potato

The explosion in USDT supply has introduced $60B in new money into the crypto ecosystem - more than 10% of the market cap of Bitcoin even at the current price level of $32,000.

That means there is real demand for USDT. One of the well-known uses for USDT is “shadow banking” - since real US dollars are highly regulated, opening an account with Binance and buying USDT is a straightforward way to get a dollar account.

The CEO of USDC himself admits in this Coindesk article: “In particular in Asia where, you know, these are dollar-denominated markets, they have to use a shadow banking system to do it...You can’t connect a bank account in China to Binance or Huobi. So you have to do it through shadow banking and they do it through tether. And so it just represents the aggregate demand. Investors and users in Asia – it’s a huge, huge piece of it.”

Binance also hosts a massive perpetual futures market, which are “cash-settled” using USDT. This allows traders to make leveraged bets of 100x margin or more...which, in laymen’s terms, is basically a speculative casino. That market alone provides around ~$27B of daily volume, where users deposit USDT to trade on margin. As a result, Binance is by far the biggest holder of USDT, with $17B sitting in its wallet.

That crazed demand for margin trading is how we can explain one of the enduring mysteries of crypto - how users can get 12.5% interest on their holdings when banks offer less than 1%.

But it’s not a fully satisfying answer. This question always persists - does everything in crypto just depend on a wave of buyers? Does everything just come back to new users or leveraged traders? How can that logic sustain itself for year-long bull runs - shouldn’t the leverage result in a collapse?

USDT might help explain this mystery. The massive supply of USDT, and the host of other dollar stablecoins like USDC, PAX, and DAI, creates an arbitrage opportunity. This brings in capital from outside the ecosystem seeking the “free money” making trades like this using a combination of 10x leverage and and 8.5% variance between stablecoins to generate an 89% profit in just a few seconds. If you’re only holding the bag for a minute, who cares if USDT is imaginary dollars?

In fact, one study finds that the primary explanation for USDT’s stability is the presence of arbitrageurs. As the study notes, flows “from the Treasury to the secondary market typically coincide with periods in which the price is above the peg.” The chart to the right shows how as USDT strays higher, funds come into the arbitrage game for a quick profit.

Lyons and Viswanth-Natraj

And that’s not the only arb trade to make. The price of Bitcoin in Korea is $1000 higher than in the US - a spread that would likely never be found elsewhere in finance outside of a total meltdown - and similar differences exist across exchanges, even for the dollar.

These opportunities multiply every day. A growing list of a hundred plus exchanges add new cryptocurrencies listed in multiple fiat currencies everyday, an exponentially growing list of listings to be exploited.

We can imagine a spectrum of arb traders ranging from those making “high quality” trades (the basis trade, USDC across exchanges, BTC/ETH, BTC/USDC) to those making low quality ones (BTC/USDT, USDT/USDC). The liquidity institutional traders bring in to “high quality” markets ultimately flows down to lower quality assets through arbitrage. (In fact, many crypto projects pay market makers to be active on their coins.)

Market makers in crypto can play similar strategies. With the cost to borrow USDT in the low to mid single digits, and wide enough crypto spreads, there are plenty of opportunities to make a profit. Every dollar of outside capital that market makers and arbitrage traders bring into the system can be easily amplified by leverage.

DeFiRate.com

Every time a company has an ICO and pays a market maker, traders are taking profit that grows their balance sheets, creates more liquidity, and grows the demand for USDT.

This, to me, is more satisfying than the “it’s all margin traders” or ICO/NFT speculation. There’s too much stability and the bubble never pops in the rapid, parabolic way that a “pure” bubble would. Crypto returns and DeFi yields are born out of these inefficiencies, and when crypto markets get wonky, those often get worse.

In summary: USDT, and other playgrounds of inefficiency, create a feeding frenzy of “free money” opportunities for savvy investors that act as a gravity well to suck in capital into the system. Liquidity and real US dollars flow in, and ultimately cycle through the system to end up as new USDT that runs the casino and keeps the cycle going.

And there is huge demand for market making and arbitrage in crypto because there are so many markets. Each wave in the crypto bubble brings a new set of fresh faces:

Author’s calculations

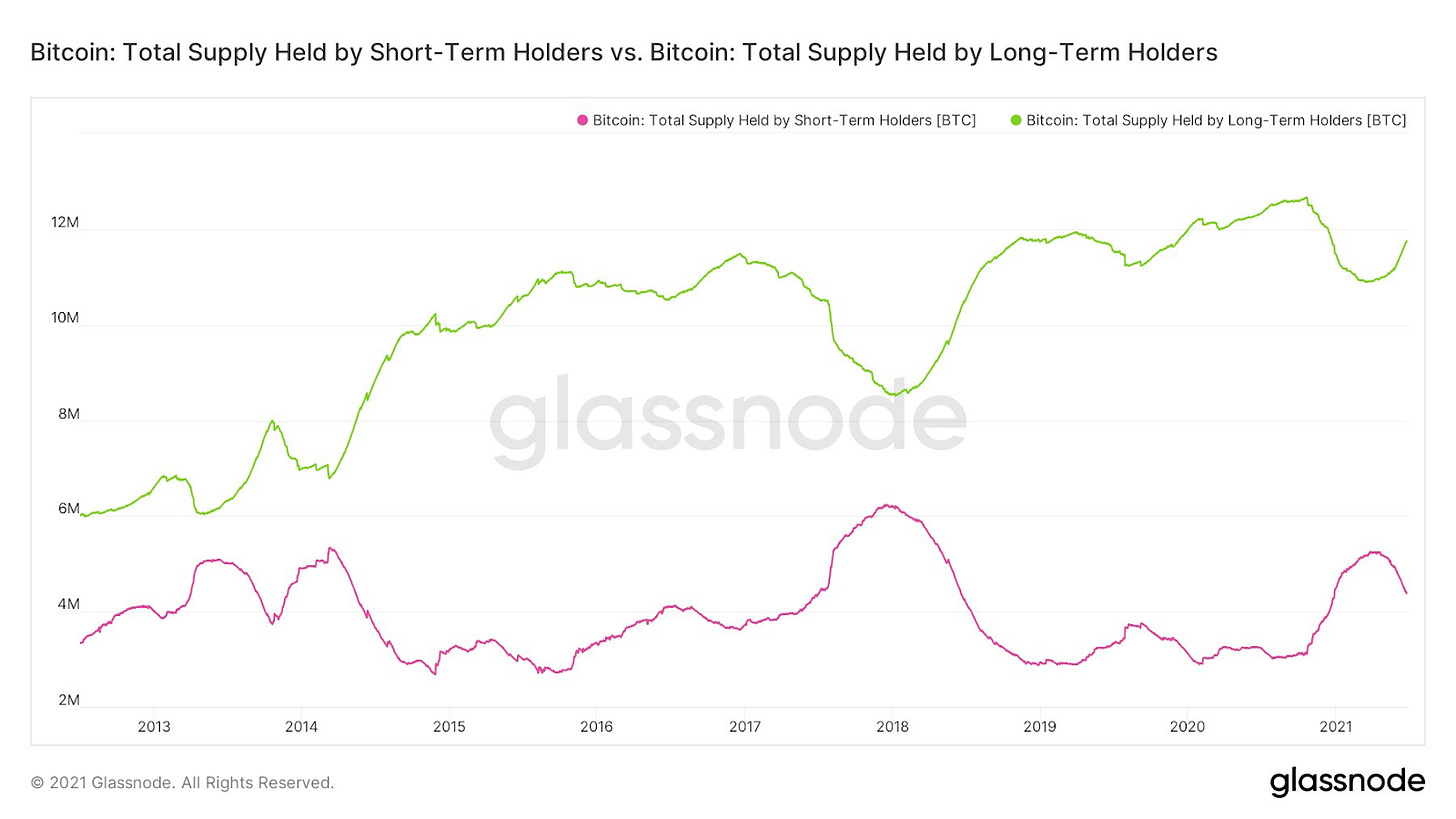

HODLers like to point to charts like this one to say pullbacks flush “weak hands” out of the system, but it can also be interpreted as the activity of professional traders seeking out easy money in inefficient markets:

The constant churn in the top end of the market and the addition of new cryptocurrencies to high quality exchanges with banking access like Coinbase creates a perfect storm for professional traders. As long as new coins get created and eventually listed, the party can go on - forever.

Unless...there’s a run on Tether.

And it turns out, there’s one very real way that could happen. Until next week!

Special thanks to Andrew Lilley for his help with thinking about the mechanics of arbitrage.