(Author’s note: I wrote this piece last week as a warning on the stability of DeFi prior to the Terra/Luna collapse. Perhaps it would now be better titled as “Barbarians Inside the Gates.” Nonetheless, I think it is still informative for understanding the flaws in the ecosystem. Note with the speed of market shifts right now, some price quotes and percentage changes may be off.)

Last month, Sam Bankman-Fried, the boy wonder of crypto, went on the Odd Lots podcast to talk about the state of the market. Bizarrely, and to the shock of the hosts, he ended up going on a long diatribe that essentially ended with the admission that most web3/DeFi tokens are little more than “perpetual motion machines.”

The guy convinced Larry David - the most ornery asshole alive - to dress up as George Washington and shill coins, but couldn’t convince himself.

You ok, dude?

But a couple weeks later, it’s clear not everything is okay. Even as Bitcoin and Ethereum held up better than many major tech stocks in this year’s rout, many DeFi coins have hit the mat - and stayed down. Is it just a panic-induced sell off? Or are there deeper fundamentals at work?

Over the last year, ETH is down ~50%, but the DeFi Index is down nearly 90%, with total capitulation in Uniswap, Synthetix, Compound, and Balancer - all blue chip DeFi protocols.

Meanwhile, TVL (total value locked - for the non-crypto natives, a metric similar to AUM) on DeFi platforms has been falling for a year.

What’s been happening to the future of finance?

I started to wonder if there were any safe places to hide. Shouldn’t everyone be running to DeFi when banks are giving nothing - less than nothing, with today’s high inflation - on your savings account? Shouldn’t DeFi protocols that provide a return be better than just holding plain vanilla Bitcoin?

But the more I looked at ways to get yield on crypto - centralized providers, staking, trading, pools - all of the data showed yields going down. Worse, everything indicated that yields were only going lower.

What if it was likely, not only that DeFi yields will go as low as - maybe even lower - than TradFi yields soon, but that flaws in these protocols mean the savviest investors are likely losing money - and many might not even know it. Instead, DeFi’s innovations are likely just becoming another money maker for arbitrage funds and middlemen.

Looking at the landscape, it seems clear that DeFi was trapped by a paradox that set up this inevitable bloodbath. The frictionless, open source nature that was supposed to make it unstoppable in the first place drove the non-stop proliferation of new platforms, driving a race to the bottom across the space. This is creating a dynamic similar to Uber/Lyft in 2015 - burning cash in the pursuit of growth. DEXes gave away hundreds of millions while DeFi tokens diluted themselves and handed out the most votes to the mercenary of investors.

All of these factors have created something like an Iron Law in DeFi: that projects with “sustainable” yields and economics will be elbowed out by the most aggressive and likely unsustainable ones.

Why does this matter? With this dynamic, the future of DeFi seems a lot like Wall Street in the 1980s: the sharks hold all the cards. Capital is concentrating in the hands of the most ruthless, and the only method of self-regulation is self-destruction.

I mean, how else did Luna and Anchor - a Ponzi wrapped within a Ponzi - become the most popular DeFi protocol of the moment?

The decline in yields over the last few months is the clearest signal that DeFi hasn’t solved some of its core problems.

Yields are the spark that lights interest in these projects - and with the sources of yield slowly being eaten away, crypto founders must turn to increasingly risky ways to compete for the marginal dollar.

The fate of the crypto markets seems to have turned into a game of chicken - racing to create exit liquidity before something too big to fail, fails. And now we wait. [Note: I kept this line as-is. There’s no reason to assume TerraUSD will be the last spectacular blowup.]

The Case of the Missing Yields

I went off in search of yield with the most famous source of all: BlockFi. After advertising their 9% rates for years - and paying a $100m fine for doing so - BlockFi’s rates have quietly been in a steep decline.

In fact, I charted out what the APY on $50,000 invested with BlockFi for various assets would look like and how that’s decreased over time:

What gives?! Although BlockFi still advertises 5%+ headline rates, they now offer those returns only for fairly paltry amounts - usually the first 0.1 BTC or 1.5 ETH, as we can see from the screenshot below:

BlockFi website. Archived April 25 2022

After that initial teaser, there is a steep drop to what is below even what stodgy old Goldman Sachs would give you!

Meanwhile, let’s jump in the Wayback Machine to compare that to what they were advertising in February 2021 - much higher rates with no asterisks!

BlockFi website. Archived February 2021

Though the highly desirable USDC rate is still at ~5-6%, it is nosediving just as US Treasury bonds now yield a respectable 3%. It honestly looks like 10 year bonds might be higher than BlockFi by the end of the year the way things are going!

BlockFi explains where the yields come from on the site: “BlockFi engages in two activities to generate return: (1) purchasing, as principal, SEC-regulated equities and predominately CFTC- regulated futures; and (2) lending crypto assets in the institutional market.”

So what do their falling yields mean? It likely reflects two things: growing supply of assets on their platform, and a fall in demand for borrowing crypto.

Borrowing has a few use cases: the less sophisticated would be simple leveraged trading (e.g. buying BTC or ETH on margin), and the more sophisticated would be arbitrage, algorithmic trading, and yield farming.

The huge difference between the rates for BTC/ETH versus USDC might help us fill in that picture. The crazed leveraged trading of yesteryear is long dead, but a high level of demand for USDC indicates financial wizardry yet lives. Still, the drop from 8.6% last year to the 5-6% range indicates the easy money may have already been made.

So how much money is left? Like Goldilocks, this CeFi stuff was too cold for me, so I went off in search of something better.

The Sins of Staking

The easiest money of all seemed to be in a good idea gone bad: staking.

Recently, Cobie, a crypto twitter favorite, chastised BAYC and ApeCoin as emblems of the excesses of staking, taking founders to task for adding staking features that have no real utility. As he writes:

In fact, if we are being truly honest about this proposal, what it really means is “lets pay existing holders for not selling while the founder/investor/contributor unlocks happen, and also so we can fake some utility before any is actually built”...There is currently ~15% of the supply liquid on the market. This inflation/emissions schedule will increase the amount of supply on the market by ~75% in only the first year…Thus, the staking program in isolation could appear harmful to the financial interests of the locked-coin holding insiders.

Unfortunately, it seems that staking has become par for the course as a means for attracting investors. Even blue-chip protocols need to offer rewards in the 6-7% range to keep users on-chain, and it’s obvious looking at the top 10 staking programs that the riskier the protocol, the more users need to be bribed with staking rewards - a slippery slope for smaller coins that is taken to even farther extremes with yield farming.

Stakingrewards.com

In the deepest jungles of DeFi are the triple digit yields, where the staking-as-bonus mentality is taken to an extreme in yield farming. In the name of science, at the start of this year I went to Trader Joe, an Avalanche-based trading site, and put my money in the highest yielding farm there was: an Avalanche-Domi pair yielding a ridiculous 265% APY. I mean who cares what the tokens do with that kind of yield, right? (For the record, DOMI is a gaming token.)

Unfortunately, this didn’t end with me retiring to a private island - even before this month’s bloodbath.

It’s Honest Work

I went into my experiment with one simple question: would I make money?

But lo and behold, as I farmed my incredible returns, the price of DOMI began to precitipiously drop. And it’s easy to see why - the rapidly inflating supply of DOMI grew 60% in 6 weeks, almost perfectly mirroring a 60% drop in its price.

The DOMI supply on Feb 16 - around 33 million

DOMI supply on March 30, only 6 weeks later: 53 million

Staking and endless bonuses are on the opposite end from CeFi - way too hot for Goldilocks, with questionable sustainability and obvious consequences. There has to be more magic behind where this internet money comes from, right? So I kept looking.

Keeping It In the Family

Although diluting your investors is a simple approach, a genuine innovation in DeFi was the DEX (decentralized exchange). This replaces the traditional exchange and its order book with a software based Automated Market Makers (AMM). AMMs are a game changer, taking back the profits of middlemen like Coinbase and Binance.

Even better, the profits made by the DEX, instead of being siphoned off, are returned to “liquidity providers” (LPs), creating a yield to investors for locking up their capital with the exchange which is used to facilitate trades. This also keeps the DeFi game going longer by keeping capital in the system rather than to exchanges’ bottom lines.

Comparing DEX to CEX volume on the Block

The most lucrative pools are almost always the Ethereum-USDC pair, since whales can park their ETH while taking less risk and generating enough return to pay for the Lambo lease and flights to Miami - usually in the high single digits or low teens, while not forcing you to hold risky coins.

So is this it? Did we finally find the perfect bowl - not too hot, not too cold?

A lengthy history of returns on this trade isn’t easy to find - DeFi Llama only goes back about two months. In fact, I bet many investors have no idea what their realized yield is, as most DeFi platforms force you to calculate it yourself rather than advertising an APY (perhaps for legal reasons…). But I was able to find some point-in-time data that shows .

But using APY Vision, we’re also able to see that since inception the pool return has steadily gone down on every popular platform. On Uniswap, for example, the return has gone from 25%+ to high single digits - barely worth the risk of locking up your capital.

Similar patterns hold up for Sushiswap, Balancer, and Curve. This is the rate for the most popular pool on Curve:

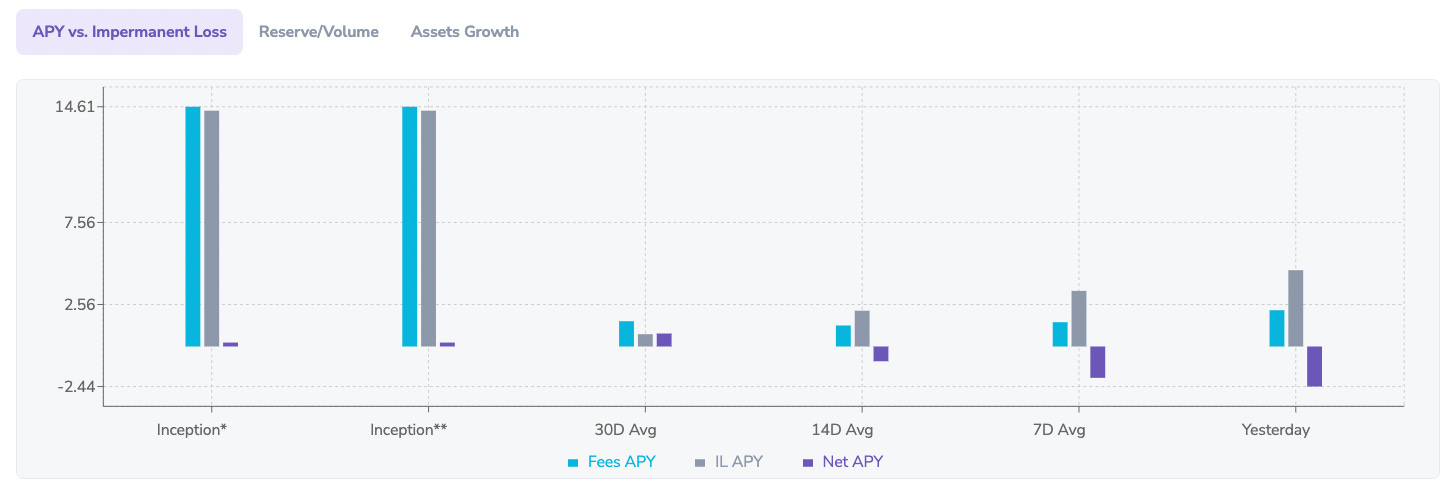

The Vision graphics above also show the concept of “Net APY” - because flaws in the system mean users lose money any time prices change, even when the prices of their coins go up. This is called “impermanent loss” - which means that even without considering the drop in ETH, the investors in this pool have made nothing!

Going back to my 250% APY, even without the price drop in DOMI and AVAX I would have made nothing - the Impermanent Loss ate up all of the trading APY. Meanwhile, before exiting, my AVAX half lost about 20% and my DOMI half lost 50%. That 35% loss nets against about 25% return in rewards I captured over the two months, netting me overall to about -10%, without even considering gas fees.

AVAX/DOMI on APY Vision

The dilution from handing out rewards had similar effects on JOE, the reward coin for the DEX. Supply doubled from 120 million around its November peak of ~$4 to 240 million:

CoinMarketCap

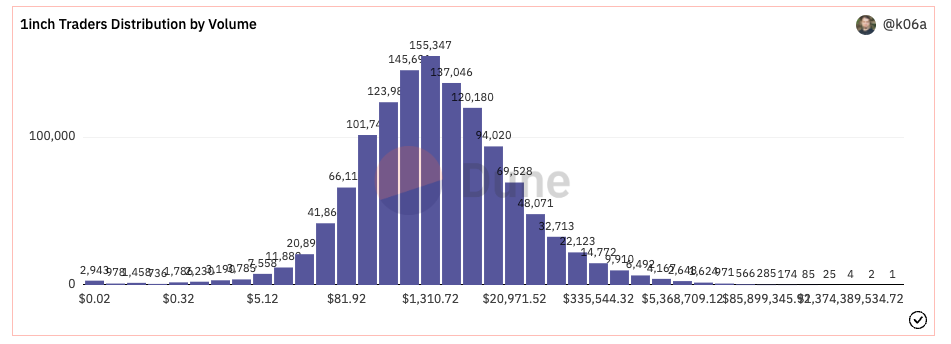

In fact, according to Dune analytics, the average transaction on DEX platforms hovers around the $1500-2500 range, meaning for many of these users are losing money net of gas costs.

Now let’s say you’re a sophisticated user and realize that impermanent loss is not your friend. The smart thing would be to join a pool with no price changes - say a stablecoin to stablecoin, like USDC to USDT. Here’s the TVL in the USDC/USDT pool at Uniswap over time, steadily climbing:

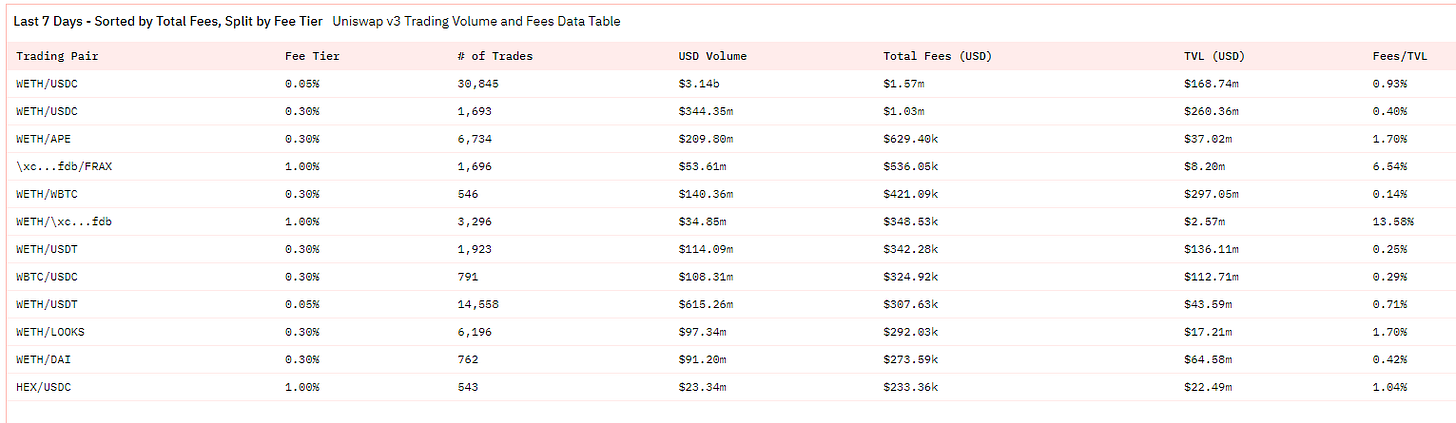

And indeed, over time users have wisened up, and now 4 out of top 10 pools on Uniswap are stablecoin pairs:

For all the supposed “degens” in DeFi, it turns out the most popular use case is to sit in USD-equivalents and collect pennies on the dollar! No surprise that a lot of whales have probably become risk averse after hitting on retirement money and are now using LPs as their bank accounts. The crypto twitterati can hate on JPOW all they want, but the data shows most of them are stacking fiat rather than the sats.

But even there the yields have come down. The DAI/USDC pool has gone from 2% to a paltry .24%:

Even the “USDT premium” has fallen. If you risk your money with USDT, widely believed to be a fraud, you’ve gone from making from 6.6% to ~2% with a lot more risk and a rate that continues to drop.

There’s a couple culprits here: 1) The pools are growing 2) Trading revenues are down. And as people shift away from the riskier coins in a bear market, that furthers the negative feedback loop.

But that’s not a great thing for DEXes either. Assets piling up in stablecoins makes it even harder to compete. Stablecoin pricing can only be so “good” (or bad) given arbitrage conditions, and so DEXes are forced to compete in other ways.

So what’s going on? Why is the bowl of perfect porridge suddenly going cold?

It turns out market conditions forced DEXes to take up new strategies, many of which ultimately ended with DeFi protocols shooting themselves in the foot.

The Dex Wars

The summer of 2021 was an exciting time to be a DEX - Uniswap had exploded in popularity, followed by Sushiswap and Curve.

The chicken-and-egg problem of bootstrapping seemed to be solved: a DEX needs trades to create yields, but traders won’t come unless there’s liquidity. That’s where “liquidity mining” came in, a concept pioneered by Uniswap at the end of 2020, which attracted users by giving away “rewards” of 20 million Uniswap tokens, or about 10% of its supply, to the first users to lock up ETH in the BTC and USD/USDT/DAI markets. This added up to likely around $100m in incentives, but was critical in getting Uniswap.

Unfortunately, liquidity mining became an increasingly effective way to light money on fire.

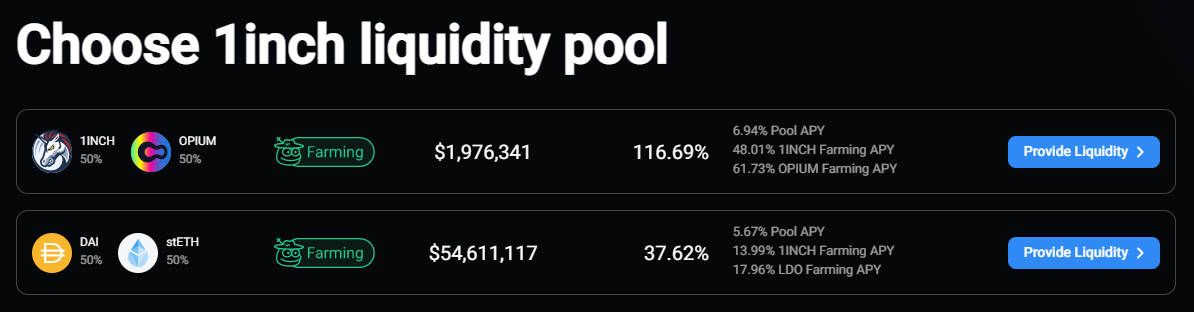

With the success of Uniswap’s LM program, the table was set: every DEX since has used some variation of the same playbook. 1inch, a DEX aggregator, advertises on its website its giveaway of 90 million tokens, likely worth upwards of $150m at issuance, and its top pools still feature massive incentives like a 48% “bonus” APY.

Avalanche’s token languished for most of 2021, losing more than 70% from peak - until August 2021, when it announced a $180m “Rush” program - a massive stimulus package set aside specifically to fund LM programs. The token surged that day, and continued to ride high for months.

$20m of that funding went directly to Trader Joe, the most popular DEX on Avalanche. That in turn funded much of my adventure into farming 265% APYs. But we can see looking more closely that almost all of that came from bonuses - about half of it in JOE, and the other half in DOMI.

A FOMO Sprint, Not a Marathon

Now why would DeFi teams go for such silly strategies that so clearly hurt them long term? Two positive feedback loops make things feel great on the way up - the buying pressure to get into the pool, and getting to claim a huge TVL.

On the buying pressure front, even though printing tokens endlessly hurts projects long term, it often works great initially! This is because to get into a liquidity pool at all usually requires multiple trades.

Think of all the ETH heads like myself who missed the Solana bubble. To run my experiment at all, I had to buy both AVAX and DOMI, supporting the price of each (even if I had both, it’s unlikely I would have them in the proportion I wanted). That also generated revenue for JOE, boosting its growth metrics. Then I had to spend AVAX to approve all these contract interactions, which generates more demand for AVAX. Since the Layer 2 tokens like JOE and DOMI on an Layer 1 token like AVAX always correlate to the L1 price, the entire ecosystem gets a boost - even when I eventually need to exit.

But most importantly, getting into the pool often requires trading against it - generating the revenues that create the yield in the first place. As long as new people keep coming in, this kind of reward “bonus” creates price support so the supply increase is mitigated - and basically creating exit liquidity for whoever was in first.

Multiply this across an entire ecosystem and use one token as the hub (AVAX) and you have a recipe for a hub token that is rapidly appreciating, which will make up for the leg that is getting rapidly diluted.

The other feedback loop is TVL (Total Value Locked). This is an important growth metric used to track the “hot” DeFi protocols, which attracts both investor interest and VC funding. That can provide another boon to the core DEX token (like JOE) even as issuing rewards creates selling pressure. Blowing funds on liquidity mining programs makes a lot of sense when some guy with a .eth handle will tweet that your “market cap to TVL ratio” is way below average and create an influx of investors. To bring in users, create buzz, and unlock even more capital in one go is a fantastic trifecta for any startup.

As Joe’s honeypot dwindled, so did the excitement around AVAX and many of its DeFi projects. After $180m of incentives, AVAX is back in the low $50s $40s $30s, right where below it was when Rush was announced.

DeFi Strikes Back

DeFi wasn’t done yet, though. Curve Finance added several innovations, altering the LP rewards system, providing less slippage than Uniswap, and significantly lower fees at 0.04% per trade while Uniswap v2 still charged 0.3%. Meanwhile, Sushiswap created more aggressive systems for rewarding users.

Meanwhile, DEX aggregators like 1inch and MetaMask swap, look for the best net price across multiple platforms - making the competition even more fierce and damaging the investments the DEXes had made in their user bases. This year aggregator market share has slowly climbed from the mid-teens to the mid-twenties:

Dune, author created dashboard

That led to a market share struggle and soon, a price war.

Uniswap would lose share to Curve and Sushiswap until the launch of v3 in May 2021, which introduced the 0.05% tier. That was followed by the even more aggressive cut to 0.01%. Since then, Uniswap has taken back the lion’s share of volume and never looked back:

https://dune.com/hagaetc/dex-metrics

And in stablecoins in particular, Uniswap’s gains were even more impressive:

So what’s wrong with a little competition? Isn’t this good for users?

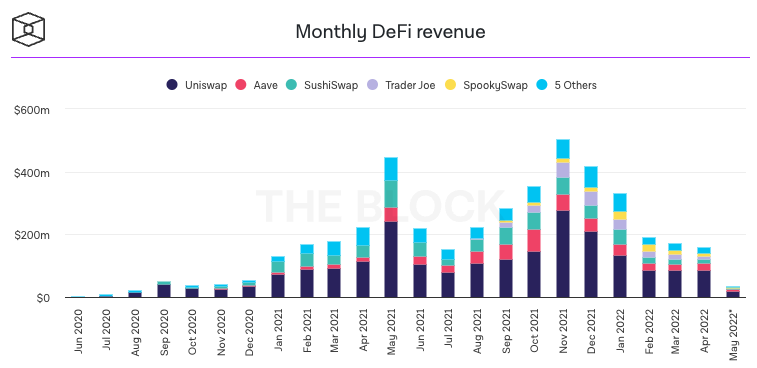

The problem is that this price war has ultimately hurt everyone’s revenues:

We can see that November 2021 - when the new .01% fee tier was introduced - was the peak for pretty much everyone. Those fees are what generate the APYs that make DeFi so popular: the price war ended up killing the golden goose.

Moreover, the proliferation of platforms - and the ease with which new ones could copy (“vampire attack”) a rival and steal their users - split trading revenues across venues, flipping the “winner-take-all” economics that justify burning money to build a platform on its head into lower APYs for everyone. Suddenly the amazing flywheel that had fed DEXes and yields’ growth was now running in reverse.

We can see this pretty clearly with the Uniswap revenues v3 launch, as fees generated shifted away from the 0.3% pool to the 0.05% pool. The daily fees generated dropped around ~50%, going from $1-2m a day down to below $1m consistently.

.3% pool, starting from May 2021

.05% pool from May 2021

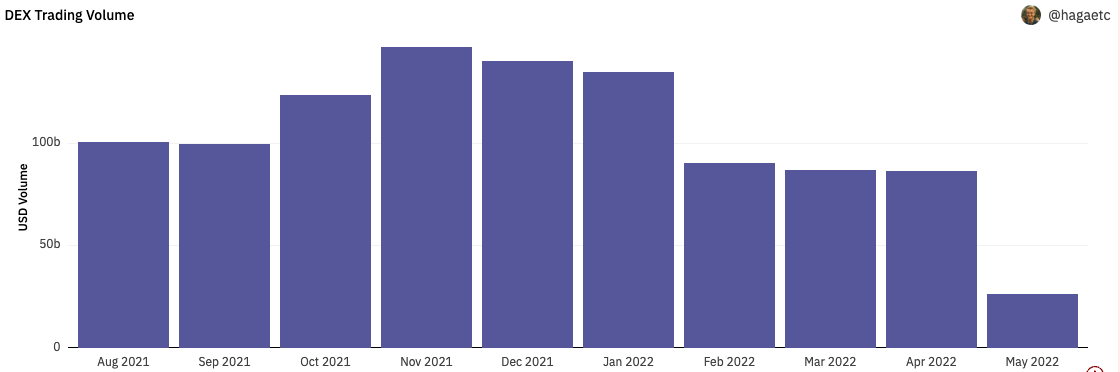

As APYs came down, trading from one pool to another to chase yield became less appealing and volume fell as well:

Now both legs of the yield magic were in trouble: the fees were as low as they could go, and the number of trades was falling. Meanwhile, TVL continued to rise:

Uniswap TVL since May 2021

The ratio of trading volume to total reserves in popular pools like USDC/wETH has fallen steadily as money chases safer places to hide. Since APY = fees / reserves, this made yields even worse.

APY Vision

We can look at the revenues versus TVL on some of these major project to see how they’ve all fared. The money spigot was running low long before the recent crash:

And the flight to stablecoins put all the money into the most boring, least profitable pools - resulting in the “bank account” state of pools today.

With the decline in yields and easy money, there is also less demand to borrow - and hence, the falling rates on sites like BlockFi suddenly make more sense. Funds that were borrowing USDC to grab piles of free money had their margins compress, and all of a sudden a major motivation for leverage was gone - an important source of new money into the ecosystem.

What we have is less a recipe for a staggering collapse like some of the many spectacular DeFi failures and more the set up for a slow, steady leak - the air coming out of the tire, until one day it’s flat.

Isn’t It ObVioUs?

The crypto-sympathetic reader will say - so you chased the most ridiculous yield out there, built on top of a shitcoin. Of course you were going to get burned! That should be obvious. After all, Coindesk declared two months ago that liquidity mining is dead (ironically, months after crypto Twitter declared it was the future).

But I would say it’s not obvious at all. APYs themselves are often hard to find and always based on past data, providing little to no information about the future. It’s also unclear how much of the trading revenue could have been wash trading, meant to create the illusion of liquidity and draw yield farmers in - so others could exit.

In TradFi, companies make their plans for issuing shares clear far in advance, and that information is all available in central databases and regular announcements. By contrast, in DeFi, when I went looking for supply schedules, I often found year old Google Sheets, APIs with a single data point and no context, and warnings from Coinmarketcap that the data was all unverified.

CoinMarketCap

Richard Chen wrote that most crypto VCs will lose money on their copycat protocols, many of which simply copied popular DeFi protocols from Ethereum to other chains like Solana and Avalanche. The irony is that many are probably farming tokens that are being pumped and diluted with incentives…using their own money.

Power to the Sharks and the Doomsday Machine

But there are other costs to the ecosystem other than losses to investors. The endless free token giveaways also often included voting rights - and now DeFi platforms have given all the power to the most ruthless investors.

Compound, the first DeFi platform arguably to find success, has been trying for months to fix its token system. Like every other platform, yields have been falling, Compound has tried to undo its past mistake of diluting itself into oblivion. As one user told the Defiant: “Since most COMP being distributed by the current rewards program is instantly sold off, existing users and token holders are at a great disservice.”

Unfortunately, though an initial step to cut rewards in half succeeded, investors balked at further reductions. Even a16z, which typically tries not to use its massive DeFi positioning to weigh in on governance, couldn’t tip the scales for a second proposal to cut rewards entirely, the proposal failed. The original DeFi protocol is now at a loss for a way to fix its broken incentive system.

Similar dynamics have played out in the Curve world. Curve once looked like an ingenious system, generating the “Curve wars” over its rewards system, but soon power became controlled by one party and concerns over governance hacks grew. Now yields there seem to be in decline as well and the token has lost two-thirds of its value, putting its rewards system at risk.

Carry this pattern out over and over and the end result is that eventually all of DeFi’s governance rights will end up in the hands of the most aggressive investors (Alameda buying 100% of a token sale being a particularly striking example).

The spectacular explosion of Terra/Luna was an obvious endpoint, despite failed attempts to rein in an overly aggressive promotion.

But was it really the endpoint? Now two years after reaching maturity, DeFi has eaten itself multiple times. Innovation in this space is weirdly Oedipal: every child spinoff of a brilliant idea seems destined to kill its parent platform.

Will investors wise up to these games? Or will DeFi perpetually be a game of hot potato, morphing from one yield-generating scheme to another?

Let’s take one final look at how my get-rich-quick scheme on Avalanche panned out. After the initial burst, trading in the AVAX/DOMI pool completely dried up:

And since then, liquidity has gradually exited:

All that’s left is a bunch of bagholders. This pool isn’t liquid enough to do any real trading, so it’s only purpose at this point would probably be arbitrage for when people exiting knock the price down. It could be that DeFi entrepreneurs really think their experiments will succeed. But after looking at charts like this for months, it seems more likely that they just don’t care.

The ETH-USDC pools are the best thing DeFi has going for it these days, but I would be willing to bet that most of the activity is arbitrage funds going between centralized exchanges and DEXes to trade the spread.

The irony of the Terra collapse is that the biggest beneficiaries were also quick-acting funds able to capitalize on the spread. And so the sharks’ pockets got fatter by a few extra billion.

These dead or zombie pools are a sign of the current crop of DeFi’s terminus - ironically, to end up as little more than a way for a few powerful players to make money as a middleman.

No matter what though, there’s one clear lesson: permissionless innovation is a double edged sword. DeFi protocols can’t create a moat to protect their businesses or users, and unless regulation comes along to change that, every strategy will be focused on the short term. As Keynes said, in the long run we’re all dead anyway.

Coming back to Sam Bankman-Fried, we can see why he went on Odd Lots and gave such an honest take. He was like the man who visited the doctor about his malady:

“I can’t eat, I can’t sleep,” said the man. “I feel constantly miserable. Please help me, doctor.”

“Laughter is the best medicine, my friend,” says the doctor. “Take yourself off to see The Great Grimaldi, a clown whose humor will cure you of all your ills.”

The man looks at the doctor for a moment. “Ah,” he says. “That won’t help.”

“Why not, sir?”

The man shrugs. “I am Grimaldi.”